Part time salary tax calculator

This calculator is always up to date and conforms to official Australian Tax Office. That means that your net pay will be 40568 per year or 3381 per month.

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

The percentage depends on your income.

. So normal part-timers dont need to pay income tax if annual income is less than 1030000 yen while 1300000 yen for part-time working students. Pay calculator Use this calculator to quickly estimate how much tax you will need to pay on your income. If your part-time income from employment was 15000 you pay.

In all there are 10 official income tax brackets in California with rates ranging from as low as 1 up to 133. The payment for the. To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above.

For example if an employee earns 1500. The Salary Calculator - 2022 2023 Tax Calculator Welcome to the Salary Calculator - UK New. How to calculate annual income.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Daily results based on a 5-day week Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the. Choose the advanced calculator if you are.

The PAYE Calculator will auto calculate your saved Main gross salary. That means that your net pay will be 43041 per year or 3587 per month. Your average tax rate.

Enter the number of hours and the rate at which you will get paid. That means that your net pay will be 37957 per year or 3163 per month. Your average tax rate is.

If the part-time income exceeds these amounts you will have to declare the excess in your tax return. If you make 55000 a year living in the region of New York USA you will be taxed 11959. It can also be used to help fill.

You can change the calculation by saving a new Main income. For example for 5 hours a month at time and a half enter 5 15. The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Updated for April 2022. How to use the UK pro rata salary calculator Choose the basic calculator if you are only interested in salary and holiday entitlement.

Income Tax Rate ranges from 5 to 45. Average salary for Part Time jobs in calculator. There are two options in case you have two different.

In the Weekly hours field. Your average tax rate is. If you make 55000 a year living in the region of California USA you will be taxed 11676.

Enter the number of hours and the rate at which you will get paid. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of. To stop the auto-calculation you will need to delete.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Thats as true for part-time work as for salary work. The adjusted annual salary can be calculated as.

Technically tax brackets end at 123 and there is a 1 tax on. That means that your net pay will be 43324 per year or 3610 per month. The Salary Calculator has been updated with the latest tax rates which.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

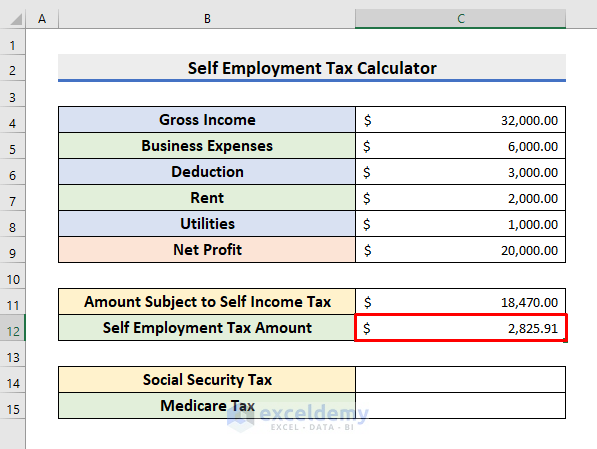

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

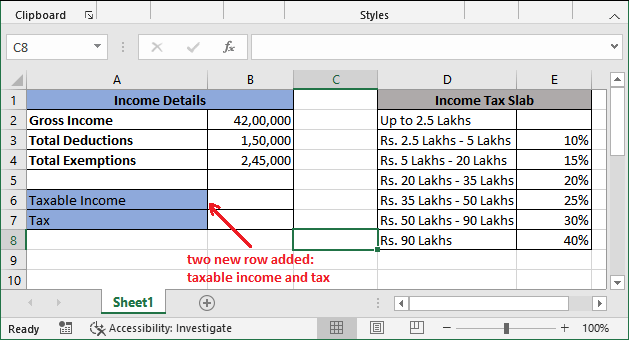

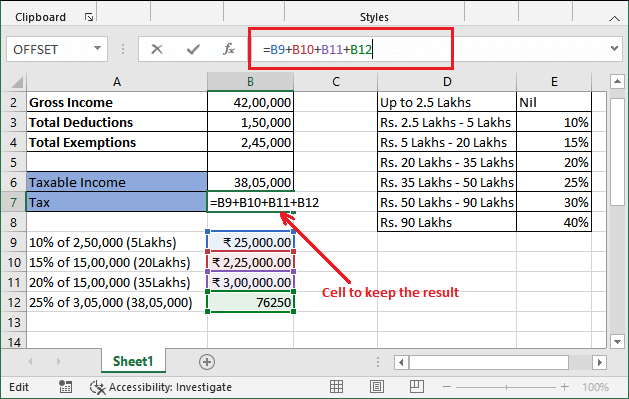

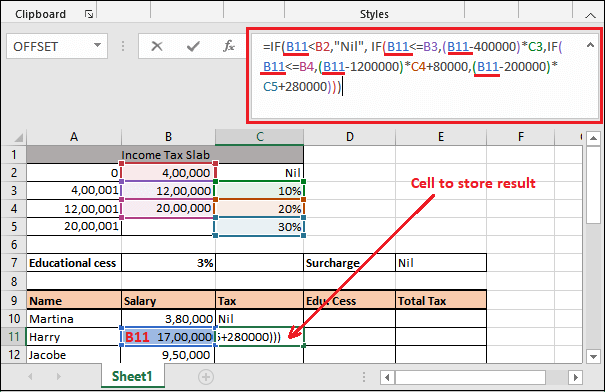

Income Tax Calculating Formula In Excel Javatpoint

Payroll Tax Calculator For Employers Gusto

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Net Pay Step By Step Example

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

Salary Formula Calculate Salary Calculator Excel Template

Income Tax Calculating Formula In Excel Javatpoint

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Ohio Paycheck Calculator Smartasset